The Fever about cryptocurrency is increasing, people have heard about it, and more and more people want to find more about it, and find a way to be a part of it. When blockchain technology came, so many things changed, for better, we say. So many businesses have improved, so many companies have started using crypto currencies in their work. The new ideas are coming every day. People want to invest in the new projects. We have the biggest tool in the world, and it is called the Internet. The internet is an enormous base of information where we can do anything. Internet has connected the entire world. One of these projects is HOMELEND

WHAT HOMELAND IS ALL ABOUT

Homelend’s platform creates an ecosystem where borrowers can fractionalize their loans. After an initial down-payment, their mortgage goes up on the platform in a sequence of ‘slices’ that can be purchased by lenders. Attached to these slices is pertinent information that would usually help determine creditworthiness.

Homelend’s platform creates an ecosystem where borrowers can fractionalize their loans. After an initial down-payment, their mortgage goes up on the platform in a sequence of ‘slices’ that can be purchased by lenders. Attached to these slices is pertinent information that would usually help determine creditworthiness.

Investors can parse the available slices on their own, and determine which they would like to invest in. If all the slices of one loan are purchased, the mortgage is issued, and the property held as collateral by Homelend. If the slices are not purchased in a specific time frame, the money is returned to the investors.

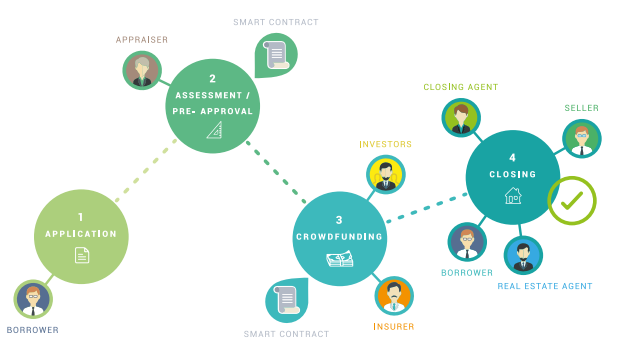

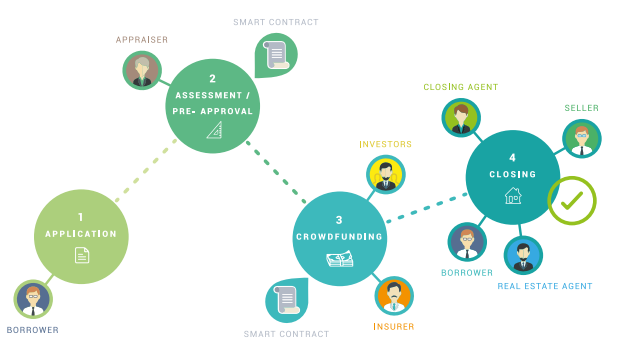

How it works

Using distributed registration (DLT) and intelligent contract technology, Homelend brings together individual borrowers and lenders on an end-to-end platform that simplifies and automates the whole process of creating a mortgage

Business model

Homelines are developed as a solution related to the blocking, which will significantly increase the likelihood of housing finance for many people and families. Our valuable offer for the sensitive social and progressive approach enshrined in P2P is aimed at the use of technology in the public interest. Nevertheless, Homelend is also based on a healthy and profitable business model, which knows about the achievement of under-received market addresses. On the one hand, Homelend creates investment opportunities for many people, with solutions that integrate traditional industries like real estate, with innovative technologies like blockchain. On the other hand, it can be for many people (who due to various circumstances, including current limitations in traditional models of credit risk, do not have a reliable credit score

WHY Homelend?

WHY Homelend?

Expanding mortgage offerings to a larger population increases potential profit streams. However, it also comes with potential risks – necessitating strict creditworthiness checks. Traditional mortgage loans use credit scores and well-established criteria to determine the level of risk. Using machine learning and artificial intelligence to aggregate historical data, Homelend leverages new methods of determining risk.

Loans offered through Homelend will still be carefully selected, avoiding any potential ‘Sub-Prime Loans’, but ‘soft’ data factors will also be considered. Age and education level can be considered, potentially opening new options for those with student loan debt. Homelend is not just seeking to open loans to millennials, they are also looking to bring new technology to a legacy industry. The Mortgage Loans sector is ripe for disruption, and most customers will appreciate a new layer of efficiency.

Security through blockchain

While a distributed ledger secures record keeping, an internal cryptocurrency can also help with keeping transaction friction low. The process of transferring cash through multiple intermediaries often results in a large loss of capital. The Homelend platform’s solution of using cryptocurrency creates an internal ecosystem where funds can flow freely. Smart contracts handle the distribution and execute at pre-determined times to ensure smooth flow of finances and information.

The Homelend platform intentionally avoids any financial middlemen that are unnecessary. While many of the functions of mortgage lending must be preserved – underwriters, insurance, appraisers – many others can be removed.

What are the Features and Benefits of Homelend

- Optimized and effective: the process of applying for mortgage loans is currently manual and lengthy. Homelend wants to use blockchain and smart contracts to make it streamlined and efficient. Homelend builds predefined business logic into intelligent contracts, digitizes documentation, and eliminates unnecessary processes. Homelend is specifically aimed at reducing the end-to-end process of borrowing mortgages from 50 days to less than 20.

- Transparent and convenient: Homelend aims to get rid of today’s ambiguous and awkward mortgage filing process and replace it with a transparent and user-friendly process. Homelend will create a crediting process that will be smart, simple and fair, allowing borrowers to easily apply for a loan, monitor the status of their application at any time and directly interact with mortgage lenders.

- Economically profitable without intermediaries: Homelend will present an economically efficient process of filing a mortgage without intermediaries. The block chain will replace the intermediaries, allowing the two defenseless sides to interact with each other. All transaction data will be recorded in the block chain, allowing borrowers and lenders to maintain maximum transparency throughout the entire transaction process.

- Reliable and secure: Homelend aims to use the blockchain to process mortgage-related data in a more reliable, transparent and secure way than ever before.

Token Details

Symbol: HMD

Symbol: HMD

Presale: March 1, 2018

Start Token Sale: TBD

End Token Sale: TBD

ICO Price: 1 ETH= 1,600 HMD

Soft Cap: 5,000,000 USD

Hard Cap: 30.000.000 USD

Ethereum ERC20 Platform

Start Token Sale: TBD

End Token Sale: TBD

ICO Price: 1 ETH= 1,600 HMD

Soft Cap: 5,000,000 USD

Hard Cap: 30.000.000 USD

Ethereum ERC20 Platform

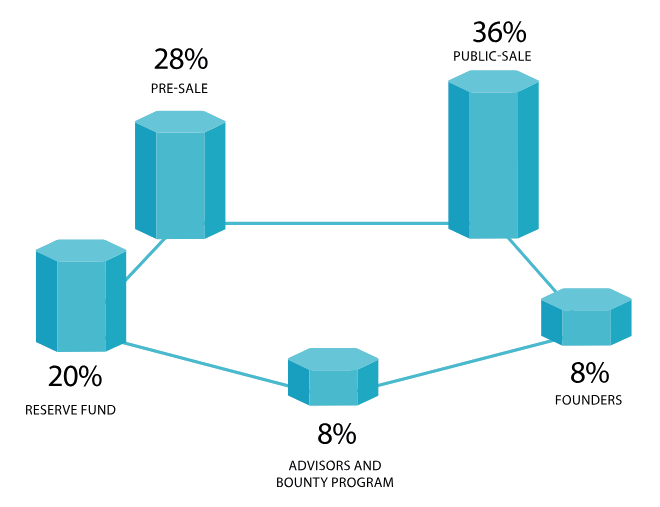

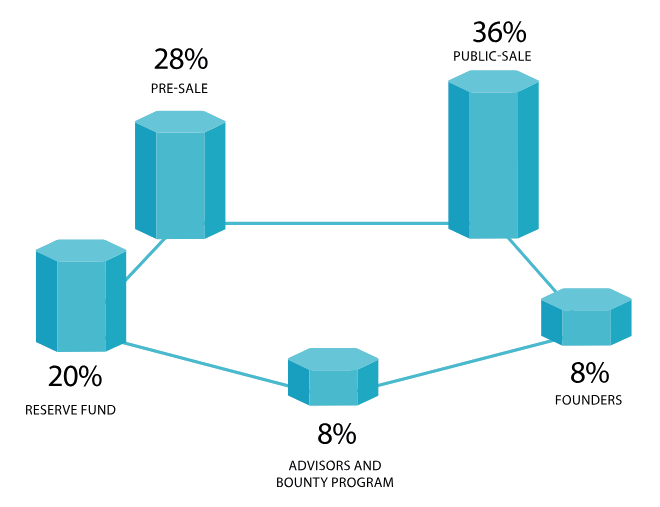

Token Allocation

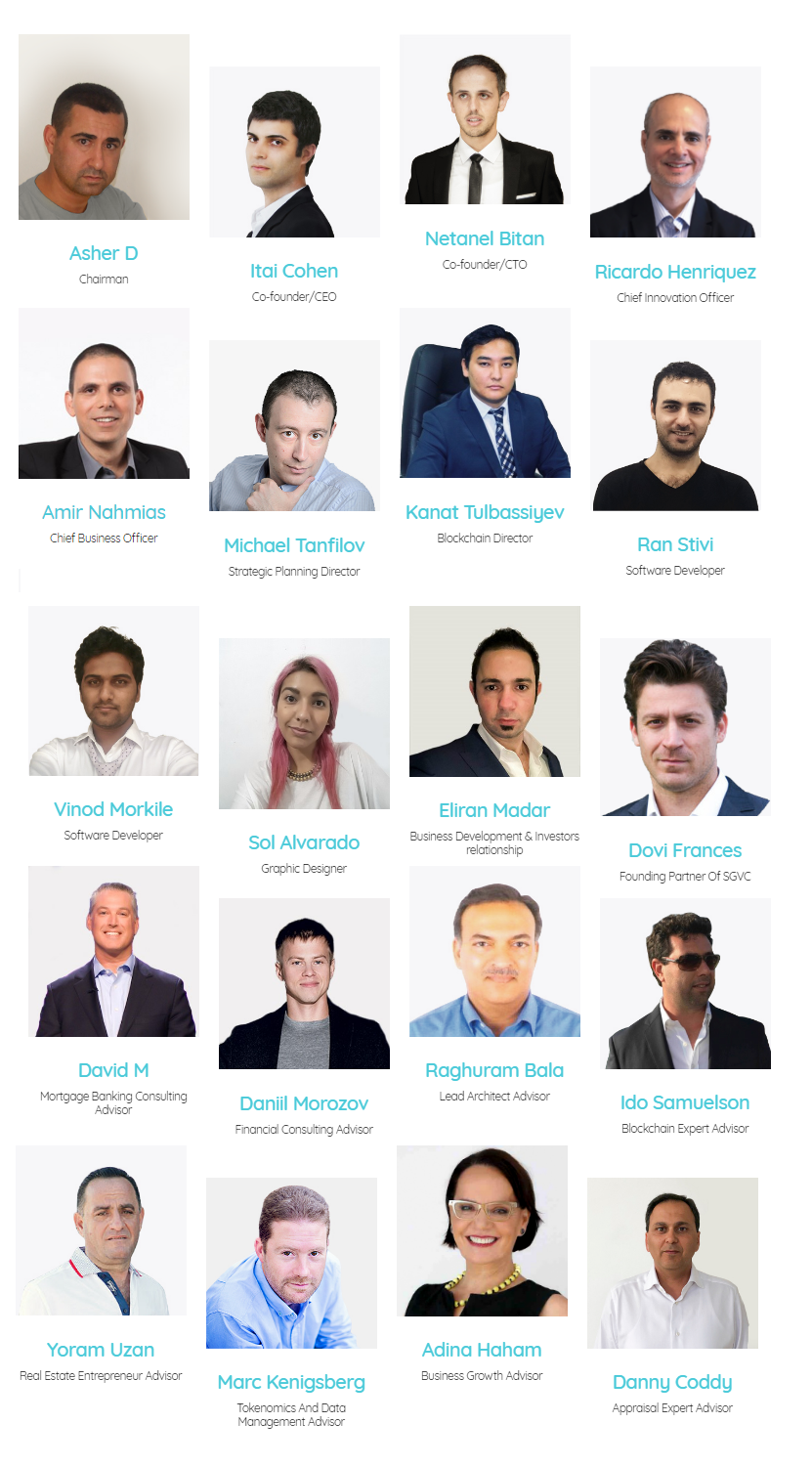

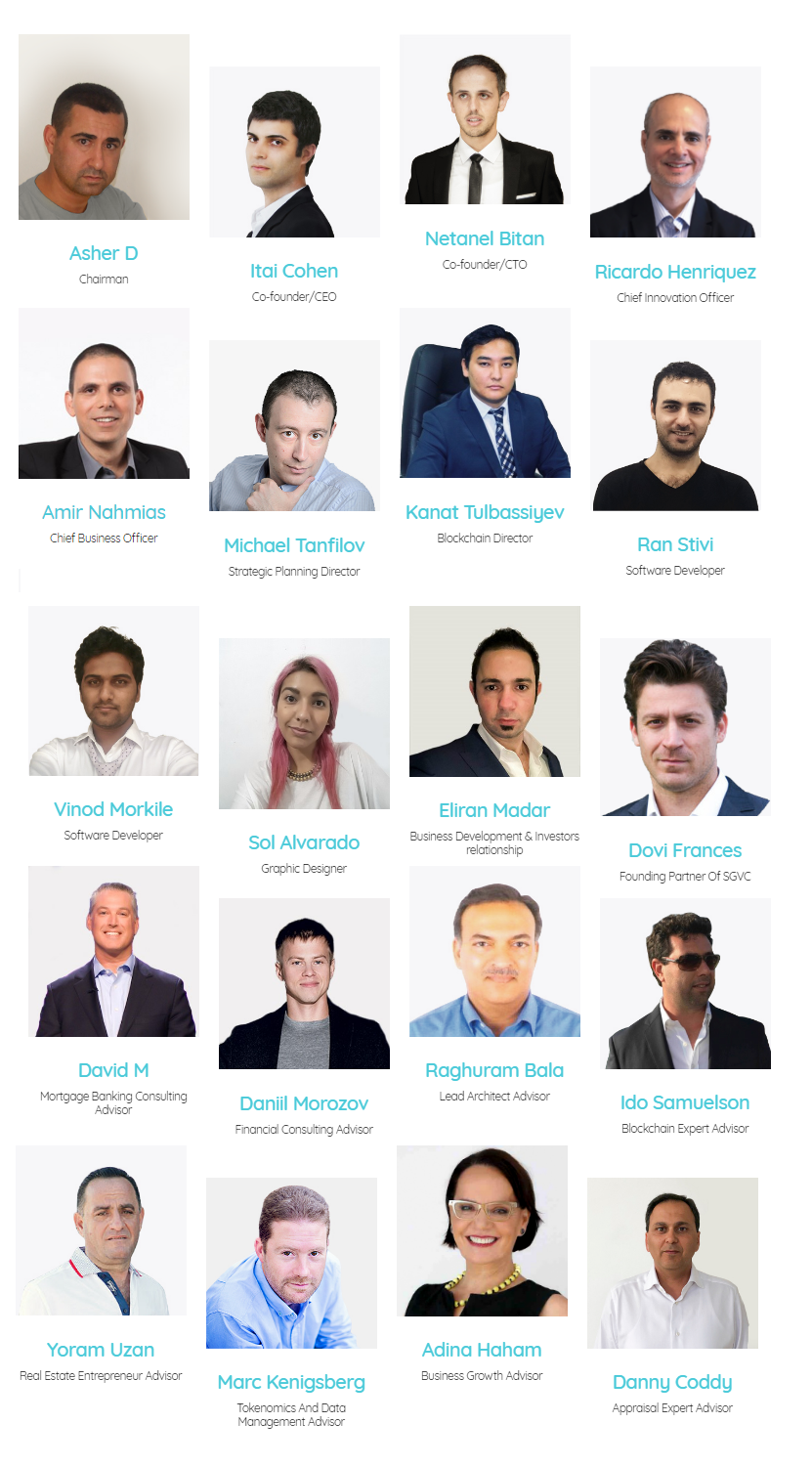

Teams of this Project

Teams of this Project

For more informationplease check the links bellow:

Website: https://www.homelend.io

Whitepaper: https://homelend.io/files/Whitepaper.pdf

ANN THREAD: https://bitcointalk.org/index.php?topic=3407541

Facebook: https://www.facebook.com/HMDHomelend/

Linkedin: https://www.linkedin.com/company/18236177/

Telegram: https://t.me/HomelendPlatform/

Twitter: https://twitter.com/homelendhmd

Youtube: https://www.youtube.com/channel/UCPLfMaovZB0Lqc9I3A7V_Rw

Whitepaper: https://homelend.io/files/Whitepaper.pdf

ANN THREAD: https://bitcointalk.org/index.php?topic=3407541

Facebook: https://www.facebook.com/HMDHomelend/

Linkedin: https://www.linkedin.com/company/18236177/

Telegram: https://t.me/HomelendPlatform/

Twitter: https://twitter.com/homelendhmd

Youtube: https://www.youtube.com/channel/UCPLfMaovZB0Lqc9I3A7V_Rw

my bitcointalk address: https://bitcointalk.org/index.php?action=profile;u=2245735

bitcointalk username: faith400

bitcointalk username: faith400

No comments:

Post a Comment